By David Bjorkgren, Special to the Hellenic News of America

Broomall, PA.- “We’re here to heighten your awareness and put a dent into fraud,” Delaware County Criminal Investigation Division Detective Anthony Reggieri told a packed room of senior citizens Thursday, Sept. 27, at St. Luke’s Greek Orthodox Church in Broomall. About 100 seniors turned out in full force to hear the presentation and learn valuable tips to prevent them from being victims of identity theft, home improvement scams, credit card theft and more.

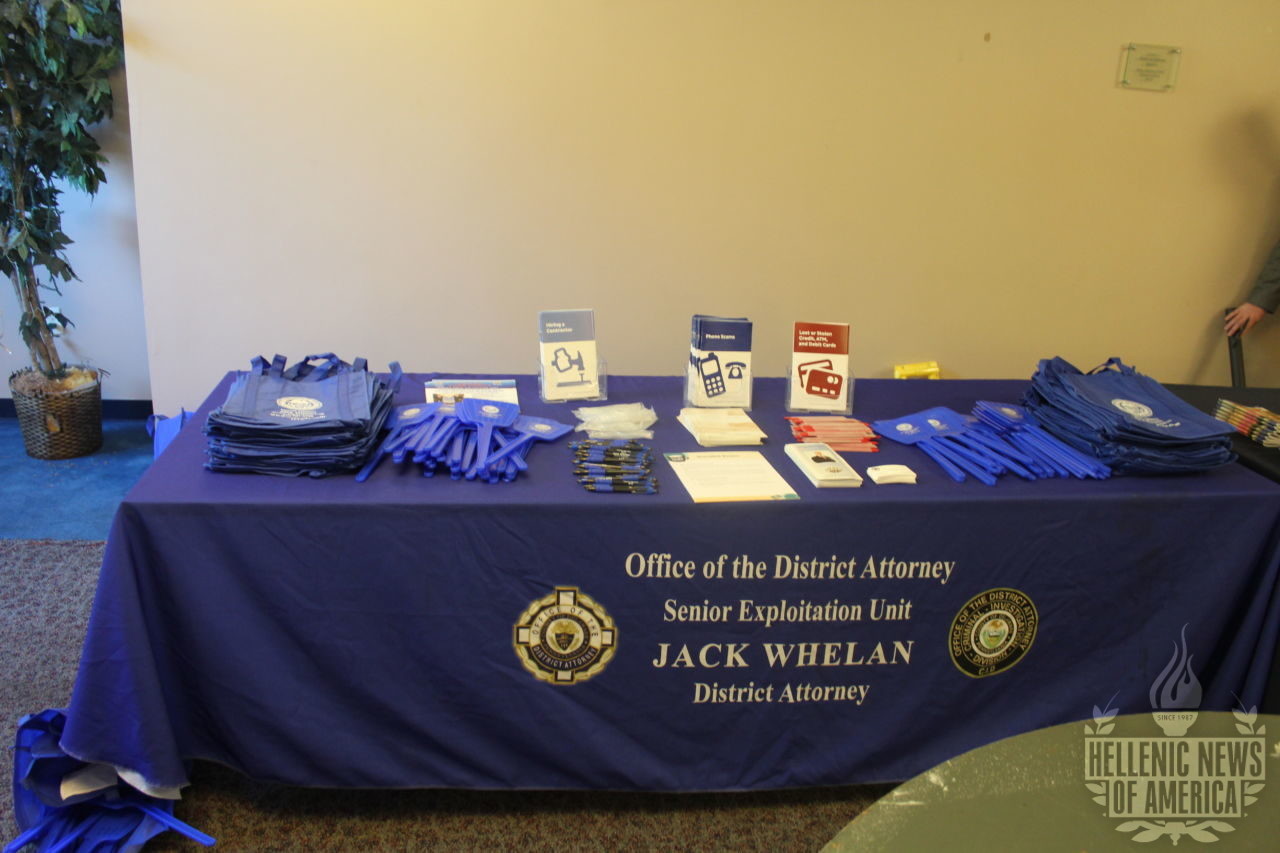

The program was organized by Elaine Karabetsos, president of the church’s senior women’s group. “I had the opportunity to make this happen and I’m just delighted with the people that came,” she said, reflecting on the large turnout. The talk led off with comments from St. Luke’s Rev. Father Christ Kontos. “The two people of the church that I love the most are the children and the seniors,” he said. “The children have their parents to care for them. A lot of times our seniors don’t have people. They trust a lot and we’ve seen too many times…people are taken advantage of so this is very meaningful.” The presentation was offered through the Delaware County District Attorney’s Office and the Senior Crime Victims Office. The presenters included Reggieri, Chelsea Price, director of the Senior Victims Office; and Marple Police Lt. Brandon Graeff.

Karabetsos said she heard about the program after a similar talk was given at White Horse Village where some of the women in her group live. “I made the initial contact and they were so helpful. It was great,” she said. Being cautious and coming forward to report fraud to police were the two main points driven home in the talk. Fear, embarrassment and worry over a loss of independence keep many seniors from reporting these crimes, but they have to come forward so others don’t become victims. Fraud happens to all folks, regardless of age or professional levels. “There was an attorney, 28 years old, she got ripped off $30,000 from a fortune teller. She had gone through a bad break up and the fortune teller prayed on her feelings and sold her all these potions.” Reggieri said. Detective Reggieri has been investigating crimes against the elderly since 1985. The scams will never go away completely. For every scam thwarted, a new one comes along, he said. The latest scam involves a man claiming to be a victim of the hurricane in Miami who has no money and only his gold jewelry to sell. The man tried the scam on an elderly Prospect Park man who suggested they visit a gold exchange store up the street. “He made the right into the store. The gypsy gentleman made a left hand turn and kept on going,” Reggieri said. That senior citizen was smart, but seniors with diminished mental capacity would have felt sorry for the scammer and bought the gold necklace or given him money, Reggieri said. Seniors are targets because they have more money, being the first generation to benefit from Social Security, high-quality pension plans and equity from their home. “My generation knows that, so when we need to borrow $1 or $500,000, we know where to go,” Reggieri said. Stealing from senior citizens is more lucrative then people out selling drugs on the street, he said. “About 80 to 90 percent of the cases I investigate are family members committing fraud against an elderly family member,” he added. Trusted relatives end up gaining power of attorney, than they spend all of the elderly person’s money. The theft isn’t often discovered until the senior dies and their Will is probated. “What the red flag should have been was that your brother was doing well and then went through a divorce and then had an addiction problem and then moved back in with mom…” Reggieri said.

There are also strangers looking to get information on you and sell it. “When you purchase a car, get a new credit card, you provide information. Some of that information is public and companies will buy that information from each other,” Reggieri said. Scammers are able to get a hold of that information and use it to open new credit accounts in your name with a different address so you never even know the account exists until you get a bill a month later for a 60-inch TV you never bought at Best Buy. Purchase a cross-cut shredder to shred old bills, address labels, financial statements, etc. so thieves won’t find out anything about you by looking through your trash. “That’s my best advice for you today. Whatever it will cost you, it will save you headaches,” Reggieri said. Don’t leave purses and wallets in cars, even if they’re hidden. Thieves will break in, steal the card and make it look like they were never there. Leave unnecessary cards, like Social Security cards, at home and don’t write your PIN number on your debit card. Don’t use debit cards on the internet because they are linked to your bank account. Get a credit card with a low balance so if it’s stolen and used on the internet you won’t be out much money. It’s also critical to check your credit report with the three credit reporting agencies—TransUnion, Equifax, and Experian. You can get a free credit report three times a year so Reggieri suggests asking for a report from each of the agencies. Those reports will show any accounts opened in your name, your credit history and who’s been checking up on you. “If you find something that’s not you, you can dispute it and have it taken off your report,” he said. Sometimes insiders will steal your information. He investigated a case where an employee of the Social Security Administration was compiling lists of seniors who had assigned someone to be in charge of their finances.

From that, she knew those seniors had diminished mental capacity. “She would sell this list to scammers and then they would start cold-calling these seniors…” with the hope of getting money from them, he said. There are all types who want to separate seniors from their money. “We’ve had bank employees,” Reggieri said. They would short every customer a dollar then put that dollar in their own account. One landscaper was able to convince an elderly woman to make him her power of attorney, giving him total control over her finances. He used $300,000 of her money to buy a car and have his house in Maryland redone. “If you are going to give someone power of attorney over your affairs be careful who you give it to,” Reggieri said. “A lot of people will have gambling habits, drug habits or they are simply living beyond their means and want to live a nice lavish lifestyle on you and I,” Reggieri said. The thieves can be police officers, attorneys, doctors, financial advisors and insurance agents. Skimmers are a new way for people to steal your information. The devices can be attached to gas pumps and ATMS over the legitimate device that is taking your credit card. You insert your card and the skimmer records the information on the card. It’s later retrieved by the thief. You should check every time you use an ATM or credit card at the pump by tugging on the area where the card goes in. If a skimmer’s attached, it will come right off. Even a waiter or waitress can be stealing your information. They’ll take your credit card and put it through a small hand-held skimmer in their apron. That skimmer holds information for thousands of credit cards. “At the end of the day, she’s selling that information to the gentleman in the rear parking lot for $500 to $1,000,” Reggieri said. Home improvement is another way to scam seniors. A person comes around with a story that they just sealed a neighbor’s driveway and have extra tar so far $100 they’ll do your driveway as well. The tar they use has been watered down with kerosene and doesn’t last. “They’re hoping it doesn’t rain because it will beat them down the driveway into the drain,” Reggieri said.

While sealing your driveway, they’ll find other things wrong at your house, padding their pockets further with cash. If you have any work done at your house, get a contract. Specify the exact work, a start date and an end date and the materials that will be used. It should be signed by you and the contractor. Any changes to the work means a new contract. Never give them cash, even if they insist. Checks can be traced by police, otherwise it’s your word against them. Telemarketing scans can be particularly lucrative. The most common phone scams involve winning the lottery and signing up for a credit card or advance free loans. “They’ll contact you by phone because they know you are home during the day and they know you’re retired and they also know you are too polite to hang up the phone,” Reggieri said. The grandparents scam is popular, says Senior Victims Office director Chelsea Price. Someone will call claiming to be your grandson or granddaughter in trouble and needing money. In the heat of the moment, you end up wiring them money. “What do we do with our family? We try to help them, right? What the grandparent scam does is make you do it in 15 or 20 minutes so you don’t have time to think. All you’re concerned about is getting your loved one out of harm’s way,” she said. By the time you stop to think, the money is gone. Another approach is to email you claiming to be your bank, saying your card has been compromised and that you need to call the number in the email. When you call, they ask you for your card information “for security purposes” to make sure it’s you, except you’re not talking to your bank. You are talking to a scammer. “What didn’t you do? You didn’t call the number that’s on the back of your credit card bill you get every month that has a legitimate number that doesn’t match the number you were told to call,” she said. Trust the number that’s on the back of your bills. If someone calls saying your card’s been compromised, call your bank and ask them. Don’t trust anything that anybody sends you through an email or voice mail, she said. A more recent scam involves on-line dating sites.

A scammer will hook up with a senior on a site. After six months of gaining their trust, they will get the senior to send them money with an excuse that they have cancer, or a child is sick, or they need money to come visit. Once the money’s sent, it goes to a fake address and it’s gone. “I just really urge you all to be cautious. If you have caller ID do not answer the phone if you do not recognize the number. If someone is trying to sell you something or ask for information, hang up. You don’t have to give information,” Price said. Always make sure to call the police or her office if you are victimized. A Senior Victims Office advocate will visit your home, accompany you to the police, try to help you get your money back and work your way through the process of prosecuting the scammers. Seniors should also be aware that even if you are on a Do Not Call list, that will not protect you from scam calls. Scammers are also switching to local 610 and 484 area codes to fool people into thinking the call is local. The crowd seemed pleased with all the information. “It was an excellent presentation and I’m going to become a little more aware when I use my credit card at my gas station,” said Anne, one of the seniors in attendance. “I thought it was very informative,” added Flo, another audience member. “It made us aware of how they get the information and made us just a little bit more aware,” she said.